Corsa Coal Announces 2019 Operational and Sales Guidance and Extension of Credit Facility to 2020

2019 Outlook

• Forecasted 33% growth in company produced metallurgical coal sales

• Reduction in cash mining costs per ton sold

• Favorable price outlook given strong fundamentals for metallurgical coal

• Growth plan on track with two new mines in 2019

December 10, 2018 – Canonsburg, Pennsylvania - Corsa Coal Corp. (TSXV: CSO) (“Corsa” or the “Company”), a premium quality metallurgical coal producer, today announced its guidance for 2019(1) and the extension of the maturity date of the term credit facility with Sprott Resource Lending Corp. from August 19, 2019 to August 19, 2020.

Unless otherwise noted, all dollar amounts in this news release are expressed in United States dollars and all ton amounts are short tons (2,000 pounds per ton). Pricing and cost per ton information is expressed on a free-on-board, or FOB, mine site basis, unless otherwise noted.

“In 2018, Corsa advanced several strategic priorities that position the business well for future success in 2019 and beyond,” said George Dethlefsen, Chief Executive Officer of Corsa. “We completed the ramp-up of the Acosta deep mine, made significant progress on the development of the Horning mine, developed the northeastern reserve base at the Casselman mine and completed a face mining equipment upgrade cycle – a move that will reduce capital expenditures in the coming years while also reducing repair and maintenance expenses and improving productivity. Additionally, we divested the thermal coal-producing Central Appalachia division to become a pure play metallurgical coal producer. While accomplishing these objectives, we also expect to have increased Company Produced(2) metallurgical coal sales levels by 23% and will have grown overall metallurgical coal sales 29% by the end of 2018.

In 2019, we are forecasting Company Produced metallurgical coal sales to increase by 33%, as the Casselman and Acosta mines are producing at full capacity and as we ramp up our Horning and Schrock Run mines. We are guiding to cash production costs per ton sold(3) of $78 to $82 in 2019, reflecting reduced costs per ton sold at both Casselman and Acosta and benefiting from the lower cost profile of our Schrock Run surface mine. In 2019, we expect to begin development work at our Keyser mine in Somerset County.

We have grown the Company at a rapid pace since 2016, increasing metallurgical coal sales by nearly 190% and increasing company produced metallurgical coal sales by 49%. Even after this progress, we believe we are only in the fifth inning of our growth story. Finishing the Horning mine development, beginning the Keyser mine and beginning the North mine are all key pieces to our long-term strategy of lowering unit costs by increasing capacity utilization at our preparation plants and achieving the financial benefits of scale.

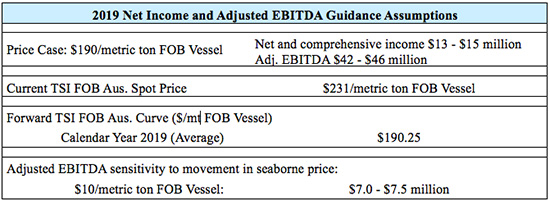

The market for metallurgical coal remains very well-supported largely due to limited production growth globally over the past several years and healthy demand from steel producers. Supply of low volatile metallurgical coal is particularly tight in the marketplace, given recent supply events. The forward curve for 2019 currently projects an average price for premium low volatile metallurgical coal of $190.25 per metric ton FOB vessel. Using a $190 per metric ton FOB vessel price outlook, we expect to generate between $13 and $15 million of net and comprehensive income and $42 and $46 million of Adjusted EBITDA(3) in 2019. We are looking forward to capitalizing on the opportunity ahead of us in 2019.”

______________________

- Guidance projections (“Guidance”) are considered “forward-looking statements” and “forward looking information” and represent management’s good faith estimates or expectations of future production and sales results as of the date hereof. Guidance is based upon certain assumptions, including, but not limited to, future cash production costs, future sales and production and the availability of coal from other suppliers that the Company may purchase. Such assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, Guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon Guidance, forward-looking statements and forward-looking information as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur.

- Corsa’s metallurgical coal sales figures are comprised of three types of sales: (i) selling coal that Corsa produces (“Company Produced”); (ii) selling coal that Corsa purchases and provides value added services (storing, washing, blending, loading) to make the coal saleable (“Value Added Services”); and (iii) selling coal that Corsa purchases on a clean or finished basis from suppliers outside the Northern Appalachia region (“Sales and Trading”).

- This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for more information.

Company Produced Tons

Our 2019 budget is focused on producing coal at our three underground mines and is benefited by a full year run rate at the Acosta mine and more favorable mining conditions at the Casselman mine. The Horning mine is expected to exit the development phase and is expected to produce a low-ash, premium quality metallurgical coal. In early 2019, we expect to begin production at the Schrock Run surface mine which is expected to be the Company’s lowest cost mine.

Value Added Services – Purchased Coal

Increasing capacity utilization rates at our infrastructure remains a strategic priority for the Company in 2019 and part of the long-term growth plans. The Company’s processing plant facilities have the capacity to double throughput with increased volumes from our company produced tons and value added services tons. Corsa has four million tons of annual processing capacity connected to rail sidings on both the CSX and Norfolk Southern railroads. Purchasing coal locally and then storing, washing, blending and loading the coal generates margin, as Corsa uses its customer relationships, infrastructure and logistics capabilities to enable regional producers to access the export market.

Sales and Trading – Purchased Coal

The Sales and Trading business line provides significant intangible benefits that help the Company drive volume growth and increases its presence in the seaborne market, as well as in the domestic purchased coal market. This helps the Company offer its customers a wide range of coal qualities and creates a margin stream that Corsa believes will be available in any pricing environment.

Export Price Realizations

At present, we have priced 39% of our 2019 low volatile metallurgical coal order book, including 650,000 tons of domestic business that is priced at an average of $112 per ton FOB mine. Currently 59% of 2019 forecasted low volatile volumes are committed. We expect our sales order book to have good diversification, with roughly equal shares of volumes being fixed, priced off the Australian index and priced off of the Platts U.S. East Coast index. We forecast approximately 71% of 2019 volumes to be exported and 29% to be sold domestically.

Guidance

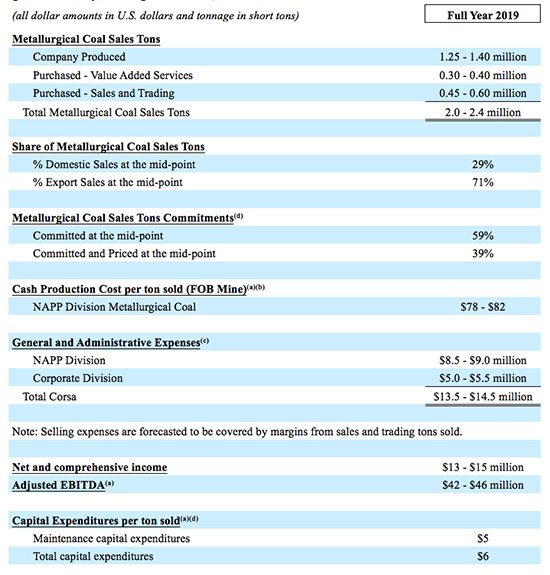

Corsa’s guidance for the year ending December 31, 2019 is as follows:

- This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for more information.

- Cash Production Cost per ton sold excludes purchased coal.

- Exclusive of stock-based compensation and selling related commissions, bank fees and finance charges.

- Tons sold excludes purchased coal used in the sales and trading platform.

Non-GAAP Financial Measures

Management uses cash production cost per ton sold, capital expenditures per ton sold and adjusted EBITDA as internal measurements of financial performance for Corsa’s mining and processing operations. These measures are not recognized under International Financial Reporting Standards (“GAAP”). Corsa believes that, in addition to the conventional measures prepared in accordance with GAAP, certain investors and other stakeholders also use these non-GAAP financial measures to evaluate Corsa’s operating and financial performance; however, these non-GAAP financial measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. Accordingly, these non-GAAP financial measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. Reference is made to the management’s discussion and analysis for the three and nine months ended September 30, 2018 for a reconciliation and definitions of non-GAAP financial measures to GAAP measures.

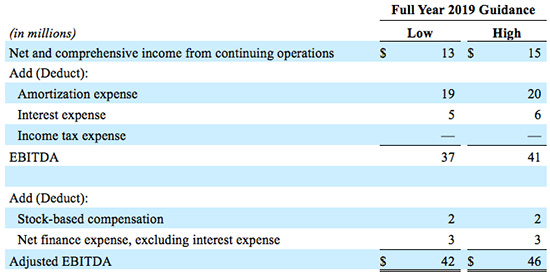

Corsa defines adjusted EBITDA as EBITDA (earnings before deductions for interest, taxes, depreciation and amortization) adjusted for change in estimate of reclamation provision for non-operating properties, impairment and write-off of mineral properties and advance royalties, gain (loss) on sale of assets and other costs, stock-based compensation, non-cash finance expenses and other non-cash adjustments. Adjusted EBITDA is used as a supplemental financial measure by management and by external users of our financial statements to assess our performance as compared to the performance of other companies in the coal industry, without regard to financing methods, historical cost basis or capital structure; the ability of our assets to generate sufficient cash flow; and our ability to incur and service debt and fund capital expenditures. Management also uses adjusted EBITDA for the purposes of making decisions to allocate resources among segments or assessing segment performance.

Below is a reconciliation of Adjusted EBITDA guidance, a non-GAAP financial measure, to the nearest GAAP financial measure:

Extension of Credit Facility

The Company’s wholly-owned subsidiary, Wilson Creek Holdings, Inc. (“WCH”), has entered into an amending agreement to extend the maturity date of its term credit facility from August 19, 2019 to August 19, 2020 and to amend certain other terms of the credit agreement (the “Credit Agreement”) governing its term credit facility made available by Sprott Resource Lending Corp.

In addition to the extension of the maturity date, the amending agreement, among other things, provides for: (i) repayments of $3.0 million on or prior to March 31, 2019 and August 30, 2019; (ii) repayment of $1.0 million on the last day of every month commencing on September 30, 2019 and ending on July 31, 2020; and (iii) repayment of certain net proceeds received, if any, by the Company as a result of a contingent receivable; and (iv) the payment of an amendment fee on September 30, 2019 in an amount equal to two percent of the then outstanding principal amount under the Credit Agreement. The effectiveness of the amending agreement is conditional upon the payment of an amendment fee in an amount equal to two percent of the current outstanding principal amount under the Credit Agreement and certain other customary conditions. The amending agreement will be filed under Corsa’s profile on www.sedar.com.

Qualified Person

All scientific and technical information contained in this news release has been reviewed and approved by Peter V. Merritts, Professional Engineer and the Company’s President - NAPP Division, who is a qualified person within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Caution

The estimated coal sales, projected market conditions and potential development disclosed in this news release are considered to be forward looking information. Readers are cautioned that actual results may vary from this forward-looking information. Actual sales are subject to variation based on a number of risks and other factors referred to under the heading “Forward-Looking Statements” below as well as demand and sales orders received.

Information about Corsa

Corsa is a coal mining company focused on the production and sales of metallurgical coal, an essential ingredient in the production of steel. Our core business is producing and selling metallurgical coal to domestic and international steel and coke producers in the Atlantic and Pacific basin markets.

For further information please contact:

Kevin M. Harrigan, Chief Financial Officer and Corporate Secretary

Corsa Coal Corp.

(724)754-0028

communication@corsacoal.com

www.corsacoal.com

Forward-Looking Statements

Certain information set forth in this press release contains “forward-looking statements”, “forward-looking information” and “future oriented financial information” (collectively, “forward-looking statements”) under applicable securities laws. Except for statements of historical fact, certain information contained herein relating to projected sales, coal prices, coal production, mine development, the capacity and recovery of Corsa’s preparation plants, expected cash production costs, geological conditions, future capital expenditures, expectations of market demand for coal and the effectiveness of the amending agreement to the Credit Agreement constitutes forward-looking statements which include management’s assessment of future plans and operations and are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Some of the forward-looking statements may be identified by words such as “estimates”, “expects” “anticipates”, “believes”, “projects”, “plans”, “capacity”, “hope”, “forecast”, “anticipate”, “could” and similar expressions. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause Corsa’s actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: risks that the actual production or sales for the 2018 or 2019 fiscal year will be less than projected production or sales for this period; risks that the prices for coal sales will be less than projected; liabilities inherent in coal mine development and production; geological, mining and processing technical problems; inability to obtain required mine licenses, mine permits and regulatory approvals or renewals required in connection with the mining and processing of coal; risks that Corsa’s preparation plants will not operate at production capacity during the relevant period, unexpected changes in coal quality and specification; variations in the coal mine or preparation plant recovery rates; dependence on third party coal transportation systems; competition for, among other things, capital, acquisitions of reserves, undeveloped lands and skilled personnel; incorrect assessments of the value of acquisitions; changes in commodity prices and exchange rates; changes in the regulations in respect to the use, mining and processing of coal; changes in regulations on refuse disposal; the effects of competition and pricing pressures in the coal market; the oversupply of, or lack of demand for, coal; inability of management to secure coal sales or third party purchase contracts; currency and interest rate fluctuations; various events which could disrupt operations and/or the transportation of coal products, including labor stoppages and severe weather conditions; the demand for and availability of rail, port and other transportation services; the ability to purchase third party coal for processing and delivery under purchase agreements; and management’s ability to anticipate and manage the foregoing factors and risks. The forward-looking statements and information contained in this press release are based on certain assumptions regarding, among other things, coal sales being consistent with expectations; future prices for coal; future currency and exchange rates; Corsa’s ability to generate sufficient cash flow from operations and access capital markets to meet its future obligations; the regulatory framework representing royalties, taxes and environmental matters in the countries in which Corsa conducts business; coal production levels; Corsa’s ability to retain qualified staff and equipment in a cost-efficient manner to meet its demand; and Corsa being able to execute its program of operational improvement and initiatives. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking statements. Corsa does not undertake to update any of the forward-looking statements contained in this press release unless required by law. The statements as to Corsa’s capacity to produce coal are no assurance that it will achieve these levels of production or that it will be able to achieve these sales levels.

The TSX Venture Exchange has in no way passed on the merits of this news release. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.