Corsa Coal Announces Financial Results for Third Quarter 2015 and Grants Stock Options

November 11, 2015 – Canonsburg, Pennsylvania - Corsa Coal Corp. (TSXV: CSO) (“Corsa”), a premium quality metallurgical and thermal coal producer, today reported financial results for the three and nine months ended September 30, 2015. Corsa has filed its unaudited Condensed Interim Financial Statements for the three and nine months ended September 30, 2015 and 2014 and related Management’s Discussion and Analysis on www.sedar.com under Corsa’s profile and has posted these documents to its website www.corsacoal.com.

Unless otherwise noted, all dollar amounts in this news release are expressed in United States dollars and all ton amounts are short tons (2,000 pounds per ton).

Three and Nine Months ending September 30, 2015 Highlights

- Despite a very challenging coal pricing environment, Corsa achieved positive adjusted EBITDA(1) at its Northern Appalachia ("NAPP") and Central Appalachia ("CAPP") divisions, as well as on a consolidated basis for the three and nine months ended September 30, 2015.

- NAPP productivity improvements and cost containment efforts have been successful with the cash production cost per ton sold(1) for metallurgical coal decreasing 11.2% from the third quarter 2014.

- The Casselman Mine successfully completed a challenging geologic transition under the Casselman River.

- Corsa's operations continue to achieve industry leading safety performance, with violation per inspection day rates that are 45% lower than the national average.

- The Quecreek Mine was restarted in May 2015 as a result of securing a long-term thermal coal sales contract that allowed Corsa to economically mine the metallurgical and thermal coal reserve base.

- NAPP continues to aggressively manage its cost structure. The mines idled during the first quarter 2015, as well as other inactive deep mining operations, were sealed, except the Horning Mine, in an effort to significantly reduce idle mine costs. NAPP incurred idle mine costs of $2,358,000 during the first nine months of 2015, which is expected to dramatically decline over the balance of the year as a result of these mines being sealed. Additionally, Corsa successfully consolidated its coal processing plants in the second quarter 2015, resulting in significant operating cost savings. Efforts are being undertaken to reduce general and administrative expenses and water treatment expenses at NAPP, and to manage reclamation efforts more efficiently.

- CAPP improved upon its first half 2015 performance by generating adjusted EBITDA(1) of approximately $2,190,000 during the third quarter 2015, driven by excellent cost performance. CAPP also has substantially completed the face up for the Cooper Ridge Deep Mine. This mine has recently commenced production in the October 2015 and will strategically reposition CAPP into the specialty coal and industrial coal markets which typically generate premium pricing.

- In February 2015, Corsa restructured its senior management team by appointing Peter Merritts to the role of President - NAPP and in June 2015, Kevin Harrigan was appointed to the role of Chief Financial Officer and Corporate Secretary.

- In October 2015, Corsa raised $7.25 million from its three significant institutional investors by way of private placement to fund working capital and for general corporate purposes.

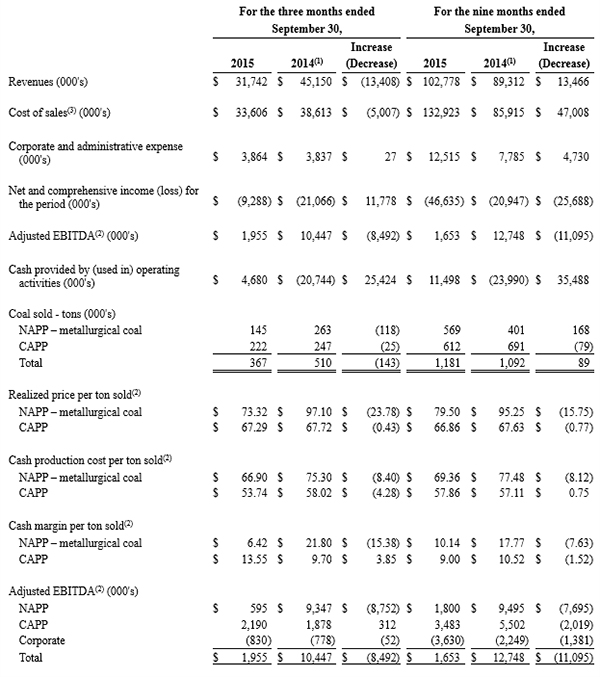

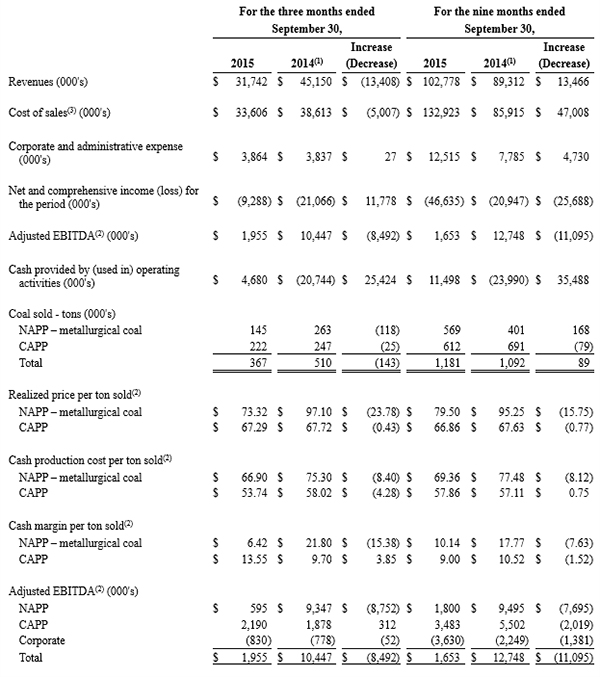

- Key Operating Metrics for the three months ended September 30, 2015:

- NAPP metallurgical coal sales of 145,000 tons.

- NAPP realized price per ton sold(1) for metallurgical coal of $73.32.

- NAPP cash production cost per ton sold(1) for metallurgical coal of $66.90, an improvement of 11% over the prior year comparable quarter.

- CAPP thermal coal sales of 222,000 tons.

- CAPP realized price per ton sold(1) for thermal coal of $67.29.

- CAPP cash production cost per ton sold(1) for thermal coal of $53.74.

George Dethlefsen, Chief Executive Officer, commented, “As the coal markets have continued to weaken over the course of 2015, Corsa’s strong operational performance and cost reduction initiatives have enabled the company to achieve positive adjusted EBITDA overall and at both the NAPP and CAPP divisions. We continue to strategically position both divisions to achieve the highest possible realized pricing for our coals, and our coal qualities, infrastructure and logistics enable us flexibility in serving several markets. Our cost cutting initiatives and asset rationalization programs have proven to be successful over the course of this year, and we expect further benefits from these programs into 2016.

We believe that our advantaged position on the delivered cost curve, premium coal qualities, and financial sponsorship will position Corsa to capitalize on opportunities in this distressed coal market. We see continued supply rationalization in the domestic metallurgical space in the coming months, which over time, should serve as a catalyst for improved pricing.”

(1)This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below.

Financial and Operations Summary

(1) The results of the assets acquired in Corsa's acquisition of PBS Coals are included from the August 19, 2014 acquisition date.

(2) This is a non-GAAP financial measure. See "Non-GAAP Financial Measures" below.

(3) Cost of sales consists of the following:

Guidance

Corsa is maintaining guidance for the year ended December 31, 2015, as per Corsa's Management's Discussion and Analysis for the year ended December 31, 2014, updated only for CAPP Division sales, which is as follows:

- Total sales of 1,645,000 to 1,785,000 tons.

- NAPP Division sales of 895,000 to 985,000 tons, including metallurgical coal sales guidance of 725,000 to 775,000 tons and thermal coal sales guidance of 170,000 to 210,000 tons. See "Coal Pricing Trends and Outlook – NAPP Division" above.

- CAPP Division sales of 750,000 to 800,000 tons of thermal coal. See "Coal Pricing Trends and Outlook – CAPP Division" above.

- NAPP Division cash production cost per ton sold(1) for metallurgical coal of $67 to $72.

- NAPP Division cash production cost per ton sold(1) for thermal coal of $30 to $35.

- CAPP Division cash production cost per ton sold(1) for thermal coal of $57 to $62.

(1)This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below.

Coal Pricing Trends and Outlook

NAPP Division

Current metallurgical coal prices remain at depressed levels where a substantial amount of global production is uneconomic. This situation arose as a result of global producers committing to multi-billion dollar projects in a significantly higher price environment. Large scale mines often take three or more years from final investment decision to first production. New supply came online over 2013 and 2014, a period where demand growth softened. This supply growth is expected to mitigate in 2015 as the pipeline of growth projects is exhausted and prices are insufficient to incentivize new production. Corsa expects that over time, the fundamentals of the metallurgical coal market will rebalance as supply growth ends and production cutbacks are implemented.

Weak Chinese demand for imported metallurgical coal, in combination with a strong U.S. dollar and low dry bulk freight rates, have continued to put downward pressure on seaborne metallurgical coal pricing. The fourth quarter 2015 coking coal benchmark pricing decreased to $89.00 per metric ton, representing a decrease of approximately 4% from the third quarter of calendar 2015 and a year-over-year decrease of approximately 25%. The fourth quarter price is the first time the benchmark settlement was below $90 per metric ton since 2004, on a nominal basis, and represents a point on the cost curve where analysts estimate over half of the global seaborne production is unprofitable.

As metallurgical coal production is rationalized in places like China, Western Canada, Australia and the United States, Corsa expects the seaborne metallurgical coal fundamentals to normalize. Domestically, severe financial distress has caused high profile bankruptcies in 2015 and may lead to additional supply cuts in the near future. This situation has also created an environment where producers are deferring capital expenditures, not reinvesting in reserves or permitting efforts, and are highly vulnerable to supply disruptions. For these reasons, Corsa believes that the domestic market is poised to rebound faster than the international seaborne market. Corsa’s geographic proximity to over 50% of domestic coke production capacity and short rail distance and multiple options to access the Baltimore export terminals solidify Corsa’s ability to take advantage of any recoveries in coal pricing.

Metallurgical coal sales in 2015 are expected to be in the range of 725,000 to 775,000 tons. Approximately 97% of these sales are currently committed at the midpoint of the range. Actual sales will depend on customer demand and market conditions. Vessel nominations for export sales are determined by customers and concluded on a month-by-month basis.

CAPP Division

Current Southeastern U.S. utility market thermal coal spot pricing declined 25% over the course of 2014. As a result, much of the Central Appalachia coal production is uneconomic. Corsa expects utility coal demand for Central Appalachia production to decrease in 2015. Conversely, industrial thermal demand grew 4% year over year for 2015 and Corsa expects industrial demand to grow in 2016.

The CAPP mineral reserve base exclusively consists of high BTU and high carbon content coal. These unique qualities, combined with advantaged logistics, set CAPP apart from other producers and create a niche in the utility and industrial marketplace. As a result, despite thermal supply outpacing demand in 2015, CAPP has been successful in maintaining a high level of contracted sales for the future.

CAPP will continue to target the industrial market segment as it transitions from a utility supplier to an industrial supplier during 2015. The planned opening of the Cooper Ridge mine will position CAPP to service the industrial specialty coal markets. These specialty markets are well suited for CAPP’s coal qualities and relatively protected from natural gas prices and historically reflect higher pricing than the thermal markets.

The CAPP coal sales for 2015 are expected to be in the range of 750,000 to 800,000 tons. Approximately 96% of these sales are currently committed at the midpoint of the range. Actual sales will depend on customer demand and market conditions. CAPP also has sales contracts in place for 350,000 tons in 2016.

Stock Options Grant

Corsa also announces that its Board of Directors has granted stock options to purchase a total of 67,712,500 common shares of Corsa (“Common Shares”) to certain directors, officers and employees of Corsa, which grant represents approximately 4.9% of the total outstanding Common Shares. These options were granted in accordance with Corsa’s Amended and Restated Option Plan (the “Option Plan”), are exercisable for five years at a price of C$0.05 per Common Share and are subject to the terms and conditions of the Option Plan and TSX Venture Exchange approval. Such options will vest one-third on the first anniversary of the date of grant, one-third on the second anniversary of the date of grant and one-third on the third anniversary of the date of grant.

George G. Dethlefsen, Chief Executive Officer, received 7,000,000 options, Kevin M. Harrigan, Chief Financial Officer and Corporate Secretary received 3,900,000 options, Peter Merritts, President – NAPP Division received 4,200,000 options, Keith Dyke, President – CAPP Division received 3,900,000 options, Joseph Gallo, Senior Vice President – NAPP Division received 2,187,500 options, Ray McElhaney, Chief Financial Officer – NAPP Division received 2,250,000 options, Steve Meehan, Vice President Sales received 1,950,000 options, Johnny Gaertner, Chief Financial Officer – CAPP Division received 1,950,000 options and certain other employees of Corsa received an aggregate of 22,390,000 options.

Options granted to Corsa’s directors were as follows: John H. Craig received 2,400,000 options, Alan M. De’Ath received 2,865,000 options, Arthur Einav received 2,650,000 options, Michael Harrison received 2,400,000 options, Robert Scott received 2,635,000 options, Daniel D. Smith received 2,400,000 options and Ronald G. Stovash received 2,635,000 options. Corbin J. Robertson III, Chairman of Corsa’s Board of Directors and a representative of Corsa’s significant shareholder Quintana Energy Partners L.P. and its affiliated investment funds, elected not to receive any options.

Non-GAAP Measures

Management uses realized price per ton sold, cash production cost per ton sold and adjusted EBITDA as internal measurements of operating performance for Corsa’s mining and processing operations. Management believes these non-GAAP measures provide useful information for investors as they provide information in addition to the GAAP measures to assist in their evaluation of the operating performance of Corsa. Reference is made to the Management’s Discussion and Analysis for the three and nine months ended September 30, 2015 for a reconciliation of non-GAAP measures to GAAP measures.

Financial Statements and Management’s Discussion and Analysis

Refer to Corsa’s unaudited Condensed Interim Consolidated Financial Statements for the three and nine months ended September 30, 2015 and 2014 and related Management’s Discussion and Analysis, filed on www.sedar.com under Corsa’s profile and posted to Corsa’s website www.corsacoal.com, for details of the financial performance of Corsa and the matters referred to in this news release.

Caution

The estimated coal sales, projected market conditions and potential development disclosed in this news release are considered to be forward looking information. Readers are cautioned that actual results may vary from this forward looking information. Actual sales are subject to variation based on a number of risks and other factors referred to under the heading “Forward-Looking Statements” below as well as demand and sales orders received.

Information about Corsa

Corsa is one of the leading suppliers of premium quality metallurgical coal, an essential ingredient in the production of steel, which is necessary for the secular trends in global urbanization. Our core business is supplying metallurgical coal with the highest safety, yield, and strength characteristics to domestic steel producers while being a strategic source of supply in the Atlantic and Pacific basin markets. Corsa also offers high heat content, low delivered cost coal to major utilities and industrial users in the Southeast region of the U.S.

For further information please contact:

Kevin M. Harrigan

Chief Financial Officer and Corporate Secretary

Corsa Coal Corp.

724-754-0028

communication@corsacoal.com

www.corsacoal.com

Forward-Looking Statements

Certain information set forth in this press release contains “forward-looking statements” and “forward-looking information” under applicable securities laws. Except for statements of historical fact, certain information contained herein relating to projected sales, coal prices, coal production, mine development, expected cash production costs, geological conditions, future capital expenditures, reduction in operating costs and expectations of market demand for coal, constitutes forward-looking statements which include management’s assessment of future plans and operations and are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Some of the forward-looking statements may be identified by words such as “estimates”, “expects”, “anticipates”, “believes”, “projects”, “plans”, “capacity”, “hope”, “forecast”, “anticipate”, “could” and similar expressions. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause Corsa’s actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: risks that the actual production or sales for the 2015 fiscal year will be less than projected production or sales for this period; risks that the prices for coal sales will be less than projected; liabilities inherent in coal mine development and production; geological, mining and processing technical problems; inability to obtain required mine licenses, mine permits and regulatory approvals or renewals required in connection with the mining and processing of coal; risks that Corsa’s preparation plants will not operate at production capacity during the relevant period, unexpected changes in coal quality and specification; variations in the coal mine or preparation plant recovery rates; dependence on third party coal transportation systems; competition for, among other things, capital, acquisitions of reserves, undeveloped lands and skilled personnel; incorrect assessments of the value of acquisitions; changes in commodity prices and exchange rates; changes in the regulations in respect to the use, mining and processing of coal; changes in regulations on refuse disposal; the effects of competition and pricing pressures in the coal market; the oversupply of, or lack of demand for, coal; inability of management to secure coal sales or third party purchase contracts; currency and interest rate fluctuations; various events which could disrupt operations and/or the transportation of coal products, including labor stoppages and severe weather conditions; the demand for and availability of rail, port and other transportation services; the ability to purchase third party coal for processing and delivery under purchase agreements; and management’s ability to anticipate and manage the foregoing factors and risks. The forward-looking statements and information contained in this press release are based on certain assumptions regarding, among other things, coal sales being consistent with expectations; future prices for coal; future currency and exchange rates; Corsa’s ability to generate sufficient cash flow from operations and access capital markets to meet its future obligations; the regulatory framework representing royalties, taxes and environmental matters in the countries in which Corsa conducts business; coal production levels; Corsa’s ability to retain qualified staff and equipment in a cost-efficient manner to meet its demand; and Corsa being able to execute its program of operational improvement and initiatives to realize cost synergies following its acquisition of PBS Coals in August 2014. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking statements. Corsa does not undertake to update any of the forward-looking statements contained in this press release unless required by law. The statements as to Corsa’s capacity to produce coal are no assurance that it will achieve these levels of production or that it will be able to achieve these sales levels.

The TSX Venture Exchange has in no way passed on the merits of this news release. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.