Corsa Coal Announces Financial Results for First Quarter 2018

May 9, 2018 – Canonsburg, Pennsylvania - Corsa Coal Corp. (TSXV: CSO) (“Corsa” or the “Company”), a premium quality metallurgical coal producer, today reported financial results for the three months ended March 31, 2018. Corsa has filed its unaudited condensed interim consolidated financial statements for the three months ended March 31, 2018 and 2017 and related management’s discussion and analysis under its profile on www.sedar.com.

Unless otherwise noted, all dollar amounts in this news release are expressed in United States dollars and all ton amounts are short tons (2,000 pounds per ton). Pricing and cost per ton information is expressed on a free-on-board, or FOB, mine site basis, unless otherwise noted.

First Quarter Highlights

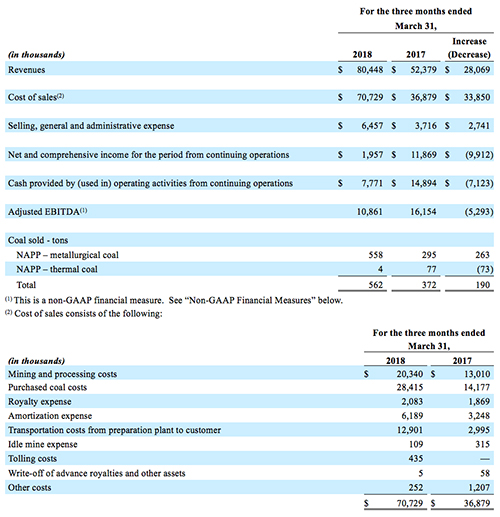

- Corsa reported net and comprehensive income from continuing operations of $2.0 million, or $0.01 per share, for the first quarter 2018, compared $11.9 million, or $0.08 per share, for the first quarter 2017.

- Operating cash flows from continuing operations for the first quarter 2018 were $7.8 million compared to $14.9 million for the first quarter 2017.

- Total revenue from continuing operations was $80.4 million for the first quarter 2018, an improvement of 54% as compared to the first quarter 2017.

- Corsa’s adjusted EBITDA(1) was $12.2 million and $10.9 million at its Northern Appalachia (“NAPP”) Division and on a consolidated basis, respectively, for the first quarter 2018. Corsa’s EBITDA(1) was $11.1 million and $9.1 million at its NAPP Division and on a consolidated basis, respectively.

- Corsa sold a total of 557,721 tons of metallurgical coal in the first quarter 2018, up 89% compared to the first quarter 2017.

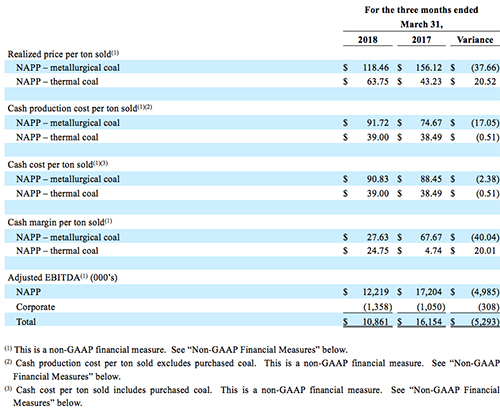

- Corsa achieved an average realized price per ton of metallurgical coal sold(1) at its NAPP Division of $118.46 for all metallurgical qualities in the first quarter 2018, this average realized price is the approximate equivalent of $164 to $169 on a free-on-board vessel basis(2) and is comprised of a mix of 22% sales to domestic customers and 78% sales to international customers.

- Corsa achieved an average realized price per ton of low volatile metallurgical coal sold(1) (totaling 388,367 tons) at its NAPP Division of $133.92 in the first quarter 2018, this average realized price is the approximate equivalent of $181 to $186 on a free-on-board vessel basis(2).

- Corsa divested its thermal and industrial coal division in March 2018, becoming a pure-play metallurgical coal producer.

- (1) This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below.

- (2) Similar to most U.S. metallurgical coal producers, Corsa reports sales and costs per ton on an FOB mine site basis and denominated in short tons. Many international metallurgical coal producers report prices and costs on a delivered-to-the-port basis, thereby including freight costs between the mine and the port. Additionally, Corsa reports sales and costs per short ton, which is approximately 10% lower than a metric ton. For the purposes of this figure, we have used an illustrative freight rate of $30-$35 per short ton. Historically, freight rates rise and fall as market prices rise and fall. As a note, most published indices for metallurgical coal report prices on a delivered-to-the-port basis and denominated in metric tons.

George Dethlefsen, Chief Executive Officer of Corsa, commented, “In the first quarter, Corsa made significant progress on its aggressive growth strategy. The first quarter was an outstanding quarter for export shipments and price realizations, as we grew our sales market share in both the international and domestic markets. Before adjusting for the sale of the Central Appalachia division, Corsa achieved record metallurgical coal sales volume levels in the quarter. We experienced strong growth in the quarter as compared to the first quarter of 2017 in each of our three business lines. Year over year, Company produced tons increased by 23%, value added services purchased coal tons increased 128% and sales and trading tons increased 390% from its launch in the first quarter of 2017.

During the quarter, Corsa executed against an operational milestone by achieving first production at the Horning mine in Somerset County, Pennsylvania. Horning will provide Corsa with a high quality, low volatile coal, which will be used across many blends, and will help move the Company closer to its stated goal of doubling metallurgical coal production from 2017 levels by 2019. Additionally, in the quarter, Corsa was successful in the sale of its thermal and industrial coal Central Appalachia division, turning the Company into a pure play metallurgical producer and shedding the associated environmental and end-of-mine closure liabilities.

There were several items that had the effect of negatively impacting profitability in the first quarter of 2018. First, Corsa encountered challenging geology at both the Casselman and Acosta mines. This led to reduced production and higher mining costs per ton for the quarter. At Casselman, we are finalizing the development of a main travel way to the northern part of the reserve base, and expect to be through this geologically difficult zone in late May. This area is a vital part of the mine which will provide access to several years of economic reserves. We are incurring additional roof support costs in order to ensure the long-term integrity of this important access point. At Acosta, we expect production to increase as we receive the final regulatory approvals for our depth of cuts and as the coal seam regains its average thickness. We view these conditions as temporary in nature and expect the mining costs per ton at these mines to return to forecasted levels in the second half of the year, if not earlier. Finally, in the quarter, Corsa incurred over $1.7 million of demurrage-related expenses with export shipments. We are optimistic that the port congestion on the U.S. East Coast will be worked through in the months ahead.

We continue to experience strong customer demand from our international customers, which has driven Corsa’s sales volume growth and profits from our purchased coal and blending activity. Domestically, steel prices are at seven year highs and the market for low volatile metallurgical coal is very tight owing to elevated demand from our customers. Metallurgical coal prices remain at healthy levels, and the forward curve remains well supported through 2020. While the spot price gets the most attention, calendar 2019 and 2020 forward prices have risen by 14% and 18% respectively since the beginning of this year. This supports the view that the seaborne market for metallurgical coal is expected to remain at profitable levels for a sustained period of time.”

First Quarter 2017 Sales Metrics

Metallurgical Coal Sales Volume

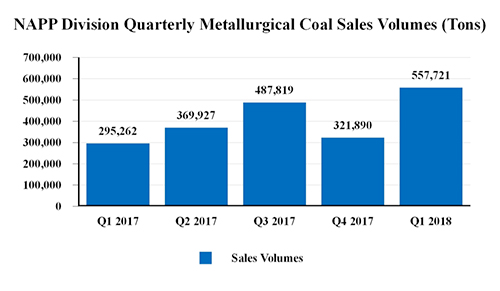

Corsa’s metallurgical coal sales in first quarter 2018 were 557,721 tons, an increase of 89% from first quarter 2017 levels. A fifteen month history of Corsa’s metallurgical coal sales volumes, adjusted for discontinued operations, is presented below.

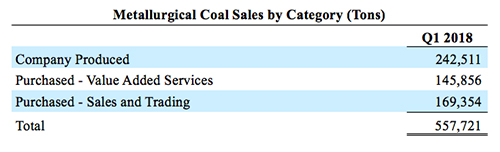

Corsa’s metallurgical coal sales figures are comprised of three types of sales: (i) selling coal that Corsa produces (“Company Produced”); (ii) selling coal that Corsa purchases and provides value added services (storing, washing, blending, loading) to make the coal saleable (“Valued Added Services”); and (iii) selling coal that Corsa purchases on a clean or finished basis from suppliers outside the Northern Appalachia region (“Sales and Trading”). For the first quarter of 2018, Corsa’s sales were broken down into the following categories.

Financial and Operations Summary

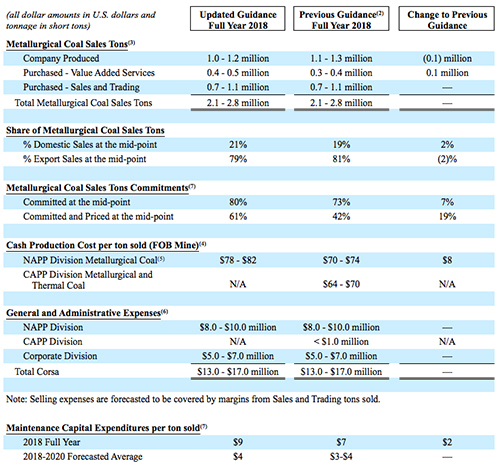

Guidance(1)

Corsa’s updated guidance for the year ending December 31, 2018 is as follows:

- Guidance projections (“Guidance”) are considered “forward-looking statements” and “forward looking information” and represent management’s good faith estimates or expectations of future production and sales results as of the date hereof. Guidance is based upon certain assumptions, including, but not limited to, future cash production costs, future sales and production and the availability of coal from other suppliers that the Company may purchase. Such assumptions may prove to be incorrect and actual results may differ materially from those anticipated. Consequently, Guidance cannot be guaranteed. As such, investors are cautioned not to place undue reliance upon Guidance, forward-looking statements and forward looking information as there can be no assurance that the plans, assumptions or expectations upon which they are placed will occur.

- Previous Guidance was presented in the Company’s MD&A for the three months and full year ended December 31, 2017 dated March 13, 2018.

- Corsa’s metallurgical coal sales figures are comprised of three types of sales: (i) selling coal that Corsa produces (“Company Produced”); (ii) selling coal that Corsa purchases and provides value added services (storing, washing, blending, loading) to make the coal saleable (“Value Added Services”); and (iii) selling coal that Corsa purchases on a clean or finished basis from suppliers outside the Northern Appalachia region (“Sales and Trading”).

- This is a non-GAAP financial measure. See “Non-GAAP Financial Measures” below for more information.

- Cash Production Cost per ton sold excludes purchased coal.

- Exclusive of stock-based compensation and selling related commissions, bank fees and finance charges.

- Tons sold excludes purchased coal used in the Sales and Trading platform.

Coal Pricing Trends and Outlook

Strong global steel demand and corresponding high levels of steel production continue to support metallurgical coal prices in both domestic and export markets. United States steel trade actions and continued economic growth have led to higher domestic steel prices, increased blast furnace production and added demand for metallurgical coal. These drivers, as well as the limited availability of high quality, low volatile metallurgical coal, should support current price levels for 2018.

Export pricing remains favorable for the balance of 2018 with metallurgical coal prices indicative of a tightly balanced supply and demand relationship. First quarter seaborne metallurgical coal prices were lifted by logistical issues and weather concerns. These supply constraints eased into the beginning of the second quarter as railroads and ports approached normal operations, vessel queues were reduced, and mills worked through inventories on hand. However, most logistics systems have limited capacity for additional throughput so there will be minimal opportunity for additional supply to put downward pressure on prices in the near term. Chinese import restrictions, production policies and high production costs for metallurgical coal, along with increased steel production in India, continue to support pricing in the export market.

The NAPP Division’s geographic proximity to over 50% of domestic coke production capacity and short rail distance and multiple options to access the Maryland and Virginia export terminals solidify Corsa’s ability to serve both domestic and international customers. Our Sales and Trading platform gives us the ability to market a greater variety of products, access more users and respond to sales opportunities.

Financial Statements and Management’s Discussion and Analysis

Refer to Corsa’s unaudited condensed interim consolidated financial statements for the three months ended March 31, 2018 and 2017 and related management’s discussion and analysis, filed under Corsa’s profile on www.sedar.com, for details of the financial performance of Corsa and the matters referred to in this news release.

Non-GAAP Financial Measures

Management uses realized price per ton sold, cash production cost per ton sold, cash cost per ton sold, cash margin per ton sold and adjusted EBITDA as internal measurements of financial performance for Corsa’s mining and processing operations. These measures are not recognized under International Financial Reporting Standards (“GAAP”). Corsa believes that, in addition to the conventional measures prepared in accordance with GAAP, certain investors and other stakeholders also use these non-GAAP financial measures to evaluate Corsa’s operating and financial performance; however, these non-GAAP financial measures do not have any standardized meaning and therefore may not be comparable to similar measures presented by other issuers. Accordingly, these non-GAAP financial measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. Reference is made to the management’s discussion and analysis for the three months ended March 31, 2018 for a reconciliation and definitions of non-GAAP financial measures to GAAP measures.

Corsa defines adjusted EBITDA as EBITDA (earnings before deductions for interest, taxes, depreciation and amortization) adjusted for change in estimate of reclamation provision for non-operating properties, impairment and write-off of mineral properties and advance royalties, gain (loss) on sale of assets and other costs, stock-based compensation, non-cash finance expenses and other non-cash adjustments. Adjusted EBITDA is used as a supplemental financial measure by management and by external users of our financial statements to assess our performance as compared to the performance of other companies in the coal industry, without regard to financing methods, historical cost basis or capital structure; the ability of our assets to generate sufficient cash flow; and our ability to incur and service debt and fund capital expenditures. Management also uses adjusted EBITDA for the purposes of making decisions to allocate resources among segments or assessing segment performance.

Qualified Person

All scientific and technical information contained in this news release has been reviewed and approved by Peter V. Merritts, Professional Engineer and the Company’s President - NAPP Division, who is a qualified person within the meaning of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

Caution

The estimated coal sales, projected market conditions and potential development disclosed in this news release are considered to be forward looking information. Readers are cautioned that actual results may vary from this forward looking information. Actual sales are subject to variation based on a number of risks and other factors referred to under the heading “Forward-Looking Statements” below as well as demand and sales orders received.

Information about Corsa

Corsa is a coal mining company focused on the production and sales of metallurgical coal, an essential ingredient in the production of steel. Our core business is producing and selling metallurgical coal to domestic and international steel and coke producers in the Atlantic and Pacific basin markets.

Earnings Call

Members of management will host a conference call on Thursday, May 10, 2018 at 10:00 a.m. (Eastern time) to discuss the Company’s results. To access the call from Canada and the U.S., dial 1.888.231.8191 (Toll Free). To access the call from other locations, dial 1.647.427.7450 (International)

The live webcast will be available at:

https://event.on24.com/wcc/r/1668993/C3381C17086805F0FF8C44450513CC6B

For further information please contact:

Kevin M. Harrigan, Chief Financial Officer and Corporate Secretary

Corsa Coal Corp.

(724)754-0028

communication@corsacoal.com

www.corsacoal.com

David Feick

LodeRock Advisors Inc.

(403)831-7557

david.feick@loderockadvisors.com

www.loderockadvisors.com

Forward-Looking Statements

Certain information set forth in this press release contains “forward-looking statements” and “forward-looking information” under applicable securities laws. Except for statements of historical fact, certain information contained herein relating to projected sales, coal prices, coal production, mine development, the capacity and recovery of Corsa’s preparation plants, expected cash production costs, geological conditions, future capital expenditures and expectations of market demand for coal, constitutes forward-looking statements which include management’s assessment of future plans and operations and are based on current internal expectations, estimates, projections, assumptions and beliefs, which may prove to be incorrect. Some of the forward-looking statements may be identified by words such as “estimates”, “expects” “anticipates”, “believes”, “projects”, “plans”, “capacity”, “hope”, “forecast”, “anticipate”, “could” and similar expressions. These statements are not guarantees of future performance and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause Corsa’s actual performance and financial results in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: risks that the actual production or sales for the 2018 fiscal year will be less than projected production or sales for this period; risks that the prices for coal sales will be less than projected; liabilities inherent in coal mine development and production; geological, mining and processing technical problems; inability to obtain required mine licenses, mine permits and regulatory approvals or renewals required in connection with the mining and processing of coal; risks that Corsa’s preparation plants will not operate at production capacity during the relevant period, unexpected changes in coal quality and specification; variations in the coal mine or preparation plant recovery rates; dependence on third party coal transportation systems; competition for, among other things, capital, acquisitions of reserves, undeveloped lands and skilled personnel; incorrect assessments of the value of acquisitions; changes in commodity prices and exchange rates; changes in the regulations in respect to the use, mining and processing of coal; changes in regulations on refuse disposal; the effects of competition and pricing pressures in the coal market; the oversupply of, or lack of demand for, coal; inability of management to secure coal sales or third party purchase contracts; currency and interest rate fluctuations; various events which could disrupt operations and/or the transportation of coal products, including labor stoppages and severe weather conditions; the demand for and availability of rail, port and other transportation services; the ability to purchase third party coal for processing and delivery under purchase agreements; and management’s ability to anticipate and manage the foregoing factors and risks. The forward-looking statements and information contained in this press release are based on certain assumptions regarding, among other things, coal sales being consistent with expectations; future prices for coal; future currency and exchange rates; Corsa’s ability to generate sufficient cash flow from operations and access capital markets to meet its future obligations; the regulatory framework representing royalties, taxes and environmental matters in the countries in which Corsa conducts business; coal production levels; Corsa’s ability to retain qualified staff and equipment in a cost-efficient manner to meet its demand; and Corsa being able to execute its program of operational improvement and initiatives. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The reader is cautioned not to place undue reliance on forward-looking statements. Corsa does not undertake to update any of the forward-looking statements contained in this press release unless required by law. The statements as to Corsa’s capacity to produce coal are no assurance that it will achieve these levels of production or that it will be able to achieve these sales levels.

The TSX Venture Exchange has in no way passed on the merits of this news release. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.